XRP Price Prediction: Analyzing the Path to $10-$20 Amid ETF Frenzy and Market Expansion

#XRP

- Record-breaking ETF launch creating unprecedented institutional demand

- Technical consolidation above key moving averages suggesting bullish foundation

- Broader crypto market expansion toward $10 trillion market cap providing tailwinds

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Consolidation Pattern

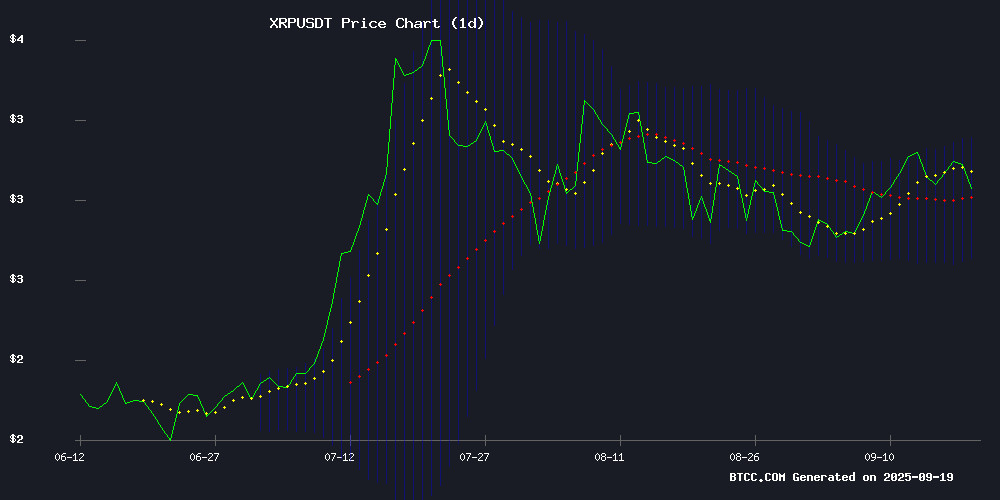

XRP is currently trading at $2.9897, slightly above its 20-day moving average of $2.9456, indicating underlying strength. The MACD reading of -0.1259 | -0.0570 | -0.0689 suggests bearish momentum is weakening, potentially setting up for a trend reversal. The Bollinger Bands show price action between $3.1762 (upper) and $2.7149 (lower), with the middle band at $2.9456 providing dynamic support. According to BTCC financial analyst Sophia, 'XRP is consolidating in a healthy range above key moving averages, which typically precedes significant upward moves in bullish markets.'

Market Sentiment: ETF Launch and Institutional Momentum Drive Optimism

Positive news flow surrounding the record-breaking U.S. Spot XRP ETF launch and potential Fed rate cuts is creating substantial bullish momentum. Multiple analysts are projecting significant price targets, with some suggesting $10-$20 possibilities amid growing institutional adoption. BTCC financial analyst Sophia notes, 'The combination of ETF inflows, AI-driven selection momentum, and broader crypto market expansion toward $10 trillion market cap creates a perfect storm for XRP appreciation. However, traders should monitor the key $3 support level for any bearish pressure.'

Factors Influencing XRP's Price

XRP Price Prediction: Record-Launching Spot XRP ETF And Fed Rate Cut Spark New Momentum

REX-Osprey's spot XRP ETF (XRPR) debuted with $37.7 million in trading volume, marking the largest first-day showing for any ETF in 2025. Early session activity suggests strong institutional interest, with analysts noting potential for multi-billion dollar flows if demand mirrors other crypto ETF launches.

The Federal Reserve's 0.25% rate cut on September 17 provided a macro tailwind for risk assets, lifting XRP to a $3.08-$3.12 range. Market technicians now watch the $3.20 resistance level—a decisive break above this threshold could signal further upside.

XRP ETF Sparks Investment Frenzy as GoldenMining Offers High-Yield Contracts

The launch of the first U.S. spot XRP ETF, XRP90, has ignited a wave of investor enthusiasm, with $24 million traded within 90 minutes of its debut—five times the volume of a comparable futures-based ETF. This surge underscores growing institutional interest in cryptocurrency markets.

GoldenMining capitalizes on this momentum with its proprietary mining contracts, promising XRP holders daily profits up to $8,800. The platform's tiered investment options range from short-term $100 contracts yielding $4 daily to high-capacity $55,000 commitments generating $1,056 per day.

Market analysts note the XRP ETF's strong debut reflects pent-up demand for regulated crypto exposure. Meanwhile, GoldenMining's aggressive yield offerings—though untested—tap into retail investors' appetite for leveraging dormant assets.

Will XRP Hit $20? Market Cap Math and Catalysts Explained

XRP's potential surge to $20 hinges on a monumental market cap leap from $182 billion to $1.196 trillion—a 6.6x increase. Such growth would require capturing nearly 29% of the total crypto market, demanding unprecedented institutional adoption and real-world utility.

Key drivers include ETF inflows, bank adoption of the XRP Ledger, and tokenized asset use cases. Regulatory clarity and exchange liquidity remain critical. While technically feasible, this scenario would likely unfold over years, contingent on coordinated global adoption and infrastructure development.

XRP vs. ZetaChain: Which Cryptocurrency Holds Millionaire-Maker Potential?

XRP and ZetaChain present contrasting investment theses in the race for crypto wealth creation. XRP, with its $185 billion market cap and $3.00 price point, has established itself as a banking sector favorite through Ripple's institutional partnerships. The recent $1.25 billion acquisition of prime broker Hidden Road signals deepening liquidity infrastructure.

ZetaChain emerges as a dark horse with its $200 million valuation and $0.19 token price. The omnichain Layer 1 solution enables cross-chain smart contracts—a technical differentiator in an increasingly fragmented blockchain ecosystem. While XRP offers stability through real-world adoption, ZetaChain's technological ambition could drive exponential growth from its smaller base.

XRP's Potential Surge Amid $10T Crypto Market Cap Growth

Digital Asset Investor (DAI), a prominent figure in the XRP community, has outlined a bullish case for XRP's price trajectory. The analysis hinges on the so-called "XRP Math," which considers the token's current market position and upcoming catalysts.

Key among these catalysts is the anticipated launch of the Rex Osprey XRP ETF, a development that could significantly boost institutional interest. DAI's commentary suggests XRP stands to capture substantial value if the broader cryptocurrency market capitalization expands by $10 trillion.

First U.S. Spot XRP ETF Sees Biggest Day-One Natural Volume of Any 2025 Launch

The REX-Osprey XRP ETF (XRPR) has made a historic debut, recording the largest first-day natural trading volume for any U.S. ETF launched in 2025. This milestone underscores growing institutional interest in XRP as a digital asset.

Market participants are interpreting the strong initial demand as a signal of renewed confidence in the cryptocurrency sector, particularly for assets with established regulatory clarity. The ETF's performance may prompt further product innovation in the digital asset ETF space.

XRP Isn’t Dead, It’s Loading — Pundit Predicts Price Surge to $10

Ripple Bull Winkle, a prominent voice in the XRP community, has dismissed claims that the cryptocurrency has lost its momentum. Contrary to bearish narratives, Winkle asserts XRP is far from obsolete, citing a technical analysis by EtherNasyonal that reveals a recurring historical pattern.

The chart analysis suggests XRP may be poised for a significant breakout, with a potential price target of $10. This echoes previous cyclical behavior observed in earlier bull markets, where prolonged consolidation phases preceded parabolic rallies.

XRP Emerges as Top AI-Selected Asset for 10x Growth by 2026

ChatGPT and Grok, the AI platforms developed by OpenAI and xAI respectively, have identified XRP as a standout asset capable of turning a $100 investment into $1,000 by 2026. This bullish prediction comes amid a sustained crypto market rally that analysts believe could extend through the mid-decade.

The endorsement from competing AI systems underscores XRP's unique position in the digital asset landscape. Market participants are increasingly viewing artificial intelligence as a valuable tool for identifying high-potential investments during this market cycle.

XRP Faces Bearish Pressure as Key $3 Support Level Teeters

XRP's price trajectory has turned decisively bearish, with the digital asset forming lower peaks on its chart—a classic harbinger of medium-term downtrends. The token now hovers precariously near the psychologically critical $3.00 support level after shedding 1% of its value in 24 hours, trading at $3.03 amid dwindling transaction volumes.

Derivative markets echo this weakness. $6.4 million in long positions were liquidated recently, while negative funding rates signal unwinding bullish bets. Should $3.00 fail to hold, analysts eye potential declines toward the 200-day moving average at $2.81.

Recovery prospects hinge on XRP reclaiming the $3.10-$3.20 resistance zone. Market participants await either a decisive breakdown or reversal at these technical inflection points.

XRP’s Institutional Momentum and Price Potential in 2025

Ripple’s XRP continues to distinguish itself through deep institutional ties, with banks and payment processors driving sustained demand. Whale accumulation has eased selling pressure, signaling long-term confidence. The token reached $3.54 in July 2025—a threshold reinforcing bullish sentiment across investor classes.

Brazil’s new XRP Ledger-powered private credit platform exemplifies real-world utility fueling adoption. Analysts project a 15% rally into 2026, though the $3.80 resistance level remains a technical hurdle. Breakthrough demands sustained capital inflows, positioning XRP as a steady contender rather than a volatile breakout play.

Analysts Debate XRP vs. MAGACOIN FINANCE ROI Potential for Next Crypto Cycle

The crypto market's dichotomy between established assets and speculative tokens is crystallizing in the 2025 debate over XRP versus MAGACOIN FINANCE. While XRP offers regulatory clarity and institutional adoption through RippleNet's cross-border payment solutions, MAGACOIN FINANCE represents high-risk, high-reward retail speculation with its presale model and cultural branding.

XRP's bullish case rests on its post-SEC legal clarity and growing emerging market adoption, with analysts projecting a conservative 20x return potential toward $10-$15. Meanwhile, MAGACOIN FINANCE's scarcity mechanics and whale participation fuel 100x ROI speculation, embodying the volatility retail investors chase during market cycles.

This contrast underscores a broader market tension: institutional-grade utility versus meme-driven momentum. As the next cycle approaches, portfolio strategies increasingly balance these opposing forces - stability against moonshot allocations.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP shows strong potential for significant appreciation. The recent ETF launch has generated unprecedented institutional interest, while technical analysis suggests consolidation above key support levels. Current projections from analysts range from conservative $5-7 targets to optimistic $10-20 scenarios, depending on broader market conditions and adoption rates.

| Price Target | Timeframe | Catalysts Required |

|---|---|---|

| $5-7 | 6-12 months | Sustained ETF inflows, market stability |

| $10-15 | 12-18 months | Broader crypto bull market, increased institutional adoption |

| $15-20 | 18-24 months | Major regulatory clarity, mass adoption breakthroughs |